NEW DELHI: The

Rs 18,000-crore

follow-on public offer (FPO) of telecoms services provider

Vodafone Idea

was

subscribed

seven times, the biggest such fund-raising move by demand size. The FPO, largest in Indian history in terms of the funds raised, was offered in the price band of Rs 10 to Rs 11 and was open from April 18 to April 22.

On April 16, the company had raised Rs 5,400 crore from a host of foreign and domestic funds that included Fidelity, UBS, Goldman Sachs, Morgan Stanley, and mutual funds like HDFC, Motilal Oswal and Quant.

The subscription for the balance Rs 12,600 crore was offered in the bidding process which was subscribed seven times and generated a demand of about Rs 88,000 crore. Together with the anchor part, total demand for the FPO stood at about Rs 93,500 crore.

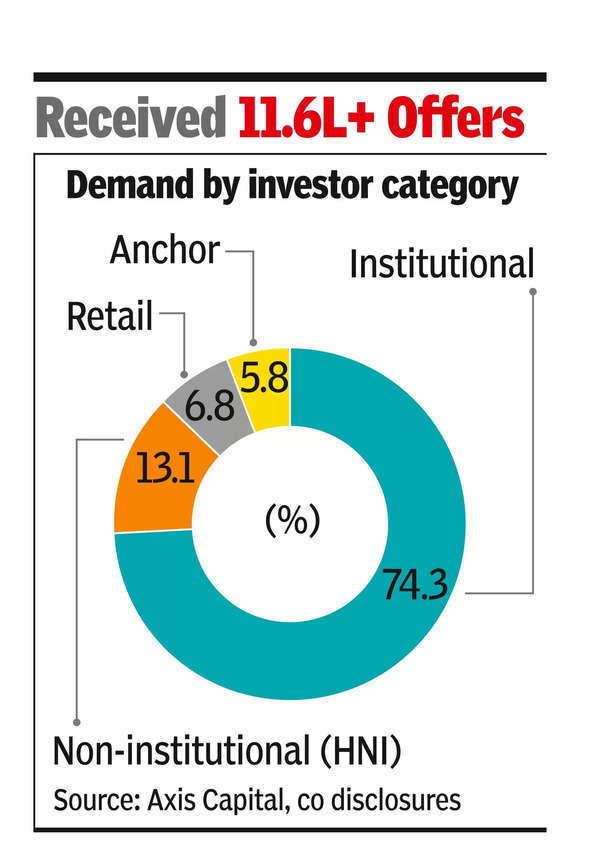

According to BSE, the institutional part of the FPO (Rs 3,600 crore) was subscribed 19.3 times, the non-insti tutional (popularly called the high-net-worth investors) part (Rs 2,700 crore) 4.5 times, while the retail part (Rs 6,300 crore) was fully subscribed.

The offer received over 11.6 lakh applications, official data showed. The shares are expected to list on April 25. After the listing, the promoters are set to infuse an additional Rs 2,075 crore in the company, at a per-share price of Rs 14.87, the company had said in the run up to the offer.

A host of analysts had recommended subscribing to the FPO saying that the fresh fund infusion, although long due, should improve prospects of the struggling telecoms services provider. Ahead of the FPO’s close, Vodafone Idea stock on the BSE ended at Rs 12.9, barely changed from its Friday close.

English (US) ·

English (US) ·