MUMBAI: The persistence of

El Nino conditions

till the first half of 2024 and its impact on

crop yields

is expected to weigh on the growth of

FMCG sector

, which is struggling with a slump in

consumption

.

The industry is expected to see subdued growth until at least the Sept quarter, estimates released by market research firm Kantar on Wednesday showed.

"

Agricultural growth

is projected to be at 1.8% in 2023-24. This is a seven-year low. According to the first estimates of kharif crops released, almost all crops have seen lower yields due to uneven rainfall. This is likely to impact the first half of 2024," said K Ramakrishnan, MD (south Asia) at Kantar Worldpanel.

Poor crop output erodes

rural incomes

, which is a key driver of FMCG demand. According to retail intelligence platform Bizom, the top 75 cities with a population of 5 lakh and above contribute about 40% to FMCG industry revenues while the rest - which it counts as rural India - accounts for 60%.

An

election year

is unlikely to boost consumption either. Analysts at Kantar said that spending during past election years has not translated into any major gains for the FMCG sector. "On the contrary, with all the freebies announced, there was only stagnation or shrinkage. In 2009, the consumption growth was 0.7%, in 2014 it was static and in 2019, it was negative... we really do not see FMCG at the national level being impacted significantly due to general elections," they said, dashing hopes of industry executives who had been banking on poll spending for demand revival.

Uneven rains in key agricultural states and a tepid festive season last year also hurt the FMCG sector, with the largest player HUL posting a drop in sales for the first time in Q3 FY24 after the pandemic-hit quarter of March 2020.

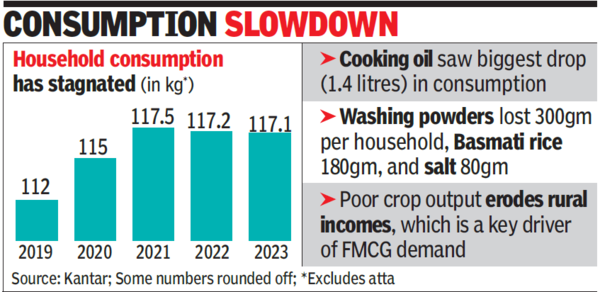

The analysis by Kantar showed that consumption has declined across most categories and also has been hit by inflation. This is evidenced by the fact that consumers have been cutting down on purchases of basic items, which can be brought in bulk like rice and cooking oil to save more and manage their finances better.

"Out of the over 90 categories and sub-categories we track, about 50% of them either lost consumption or were static. The biggest such average consumption drop was seen for cooking oils, where 1.4 fewer litres were purchased in 2023 compared to 2022... followed by washing powders which lost 300gm per household, basmati rice which lost 180gm and salt which lost 80gm... each of these are bulk purchase categories where usage can be regulated and that seems to be what is happening here," the firm said.

However, FMCG spends have risen solely on the back of price rises. In fact, removal of atta from the FMCG volume mix for 2023 showed that sectoral volumes grew by only 2.7%. Atta generated 16% of all FMCG volumes last year.

English (US) ·

English (US) ·