MUMBAI:

RBI

governor Shaktikanta Das said the central bank has approved a platform that will facilitate

online merchants

to receive payments from any bank via

internet banking

, without signing up for every bank.

Bharat Bill Payment System

, an arm of the National Payments Corporation of India, will implement a new system of

interoperable

netbanking payments. This feature will make it easier for smaller businesses to do

e-commerce

, as even small payment aggregators can provide this service without on-boarding banks individually. The lower effort for payment aggregators is expected to result in lower payment charges for merchants.

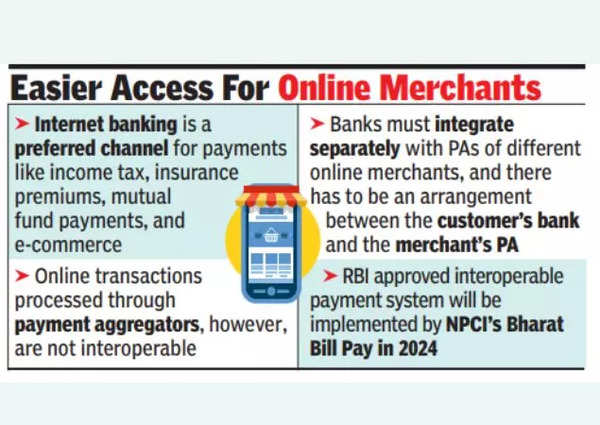

Das said that internet banking is one of the oldest modes of online merchant payment transactions and is a preferred channel for payments like

income tax

, insurance premiums, mutual fund payments, and e-commerce.

At present, such transactions processed through payment aggregators are not interoperable. A bank must integrate separately with each PA of different online merchants and there must be an arrangement between the customer's bank and the merchant's PA.

"Given the multiple number of payment aggregators, it is difficult for each bank to integrate with each PA. Further, due to the lack of a payment system and a set of rules for these transactions, there are delays in actual receipt of payments by merchants and settlement risks," said Das. The governor added that these issues would be addressed with RBI's approval for an interoperable payment system for internet banking transactions, which will be implemented by NPCI's Bharat Bill Pay - which is to launch in 2024.

The governor spoke at RBI's Digital Payments Awareness Week event in Mumbai. Das said retail digital payments have grown from 162 crore transactions in FY13 to 14,726 crore in FY24 (until Feb) - a 90-fold increase in 12 years.

"Today, India accounts for nearly 46% of the world's digital transactions as per 2022 data. The extraordinary growth in digital payments is also evident in RBI's Digital Payment Index, which has witnessed a four-fold rise in the last five years," said Das.

English (US) ·

English (US) ·