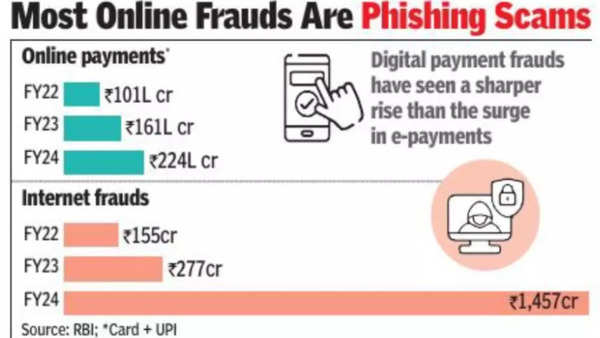

MUMBAI : Online payments have grown at a fast clip in recent years but frauds in such transactions have grown faster.

Credit card

and

online frauds

have increased 425% to Rs 1,457 crore FY24 from Rs 277 crore in the year-ago period.

The number of such frauds has risen 334% to 29,082 during the same period. Card and UPI payments rose nearly 40% to just over Rs 224 lakh crore in FY24.

According to

RBI

’s annual report, over the last three years, private sector banks reported the maximum number of frauds due to

cybercrimes

.

However, overall, it was public sector banks that contributed the most in value terms as a result of their corporate loans.

The number of

bank frauds

have gone from 9,046 in FY22 to 13,564 in FY23, rising an additional 165% to 36,075 in FY24. Private banks saw a 69% increase in fraud cases to 8,979 in FY23 from 4,312 in FY22. In FY24, they rose by 169% to 24,210.

The number of frauds in the private sector alone have increased 355% to 24,210 in FY24 from 5,312 in FY22. In volume terms, the majority of frauds have occurred in the

digital payments

(card/ internet) category, while in terms of value, frauds have been primarily reported in the loan portfolio (advances category). However, there was a 46.7% decline in the amount involved in the total frauds reported in FY24, which fell to Rs 13,930 crore from Rs 26,127 crore in FY23.

A majority of online frauds are phishing scams, where the account holder is tricked into providing sensitive information or making payments to fraudsters impersonating another individual. Govt has launched the National Cyber Crime Reporting Portal to enable quick reporting of such cases. A toll-free helpline — 1930 — has been operationalised to get assistance.

RBI also plans to establish a cyber range to enhance response to cyber incidents for scheduled commercial banks and improve supervisory capabilities with SupTech (supervisory technology) data tools for micro-data analytics and other applications using AI and machine learning as part of its Utkarsh 2.0 initiative for 2024-25.

Meanwhile, the number of fake currency notes in circulation dropped from 2.3 lakh in FY23 to 2.2 lakh in FY24. The withdrawal of the Rs 2,000 notes has led to an increase in the number of fake notes detected, which rose to 26,035 from 9,806 last year.

In FY22, banks reported 3,596 cases of credit card and internet fraud amounting to Rs 155 crore. This number increased to 6,699 cases with a value of Rs 277 crore in FY23. FY24 saw a major jump, with cases rising to 29,082 and the amount rising to Rs 1,457 crore.

English (US) ·

English (US) ·